Register

Worth Ave. Group - Providing peace of mind to consumers for over 50 years.

Why Buy Tablet Insurance?

Posted:

June 24, 2022

Categories:

General

Whether for watching videos, playing games, reading books, or browsing the web, tablets are fantastic devices that you can use everywhere: they are light, portable, and practical. But, they are also fragile and can be easily damaged or stolen. Tablet insurance can help you protect your device from damage and theft and save on pricey repairs and replacements.

There are many reasons why an insurance plan can be worthwhile coverage for your tablet. Accidents can happen within seconds; repairing or replacing a tablet is expensive; tablets are an attractive target for thieves, to name a few. Of course, you can’t foresee these unfortunate events, but what you can do is protect yourself and your peace of mind when they happen.

What is tablet insurance?

Tablet insurance is like any other device insurance plan, but this one, as the name suggests, is specifically designed for tablets. It protects your tablet from everyday mishaps and helps you repair or replace your device if it gets accidentally damaged or stolen. Besides accidental damage and theft, Worth Ave. Group insurance plan can even protect your tablet in the event of a fire, flood, natural disaster, or power surge caused by lightning!

What’s the difference between tablet insurance and a warranty?

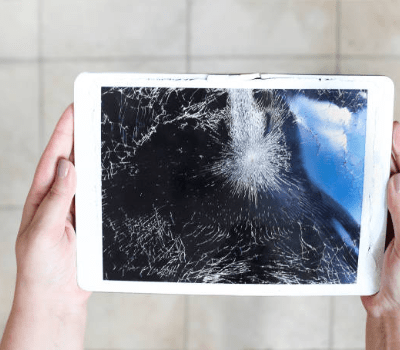

Tablet insurance covers different things than standard tablet warranties. Tablet warranties are helpful regarding mechanical defects and failures, but they don’t cover things like accidental damage or theft. That’s where tablet insurance comes in. Tablet insurance goes beyond the warranty and keeps your device safe from common accidents such as drops, spills, or cracked screens.

Is tablet insurance worth it?

Losing access to your tablet due to accidental damage is stressful enough, not to mention finding a good repair store or paying out-of-pocket for this unexpected expense. And what if your tablet or your child’s tablet is stolen or severely damaged by a fire or flood? You would have to replace it, which can be extremely expensive. The right tablet insurance plan can set your mind at ease by saving you a lot of money and hassle if your valuable device gets accidentally damaged or stolen.

Do I need tablet insurance?

When deciding whether you need tablet insurance, consider how not having your tablet would impact your everyday activities and whether you can afford to repair or replace your gadget if anything happens to it. If you heavily rely on your tablet, have an expensive device, or take it everywhere you go, there is no doubt that tablet insurance is valuable protection for you.

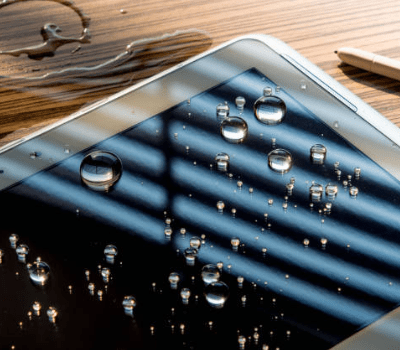

Another situation in which tablet insurance is something you definitely should not overlook is when kids use these devices. No matter how much you teach them to be careful with their tablets, kids will be kids, so cracked screens or water-damaged devices are just some of the things you can expect when they return from school, the playground, or their friend’s house. With our tablet insurance, you can breathe easy knowing that your kid’s tablet is covered, no matter how many times they crack its screen, drop it in water, or crush it in their backpack.

How does tablet insurance work?

First, you need to buy an insurance plan before a device mishap happens. And getting an insurance policy with Worth Ave. Group is easy: you choose your state, user type, coverage amount, policy term, and payment option. It’s as simple as that: you have coverage for your tablet for an affordable monthly or annual premium. If something happens to your tablet and the incident is covered by the insurance plan, you only need to file a claim and pay a deductible while we take care of the rest.

How much does it cost to insure a tablet?

Your insurance premium will depend on your tablet’s value, the period you want your insurance policy to remain active, whether you choose to pay annually or monthly, and the state where you live. It’s important to point out that insuring a tablet costs significantly less than repairing or replacing a tablet without an insurance plan. A professional repair can easily cost hundreds of dollars, while our insurance plans start at just $38 a year! So, just one drop on the ground, and having insurance pays off.

What does tablet insurance cover?

Worth Ave. Group insurance plan covers all tablet models, regardless of whether they are new, used, or refurbished, for the following losses:

- Cracked screens

- Spills and liquid submersion

- Accidental damage (Drops)

- Theft and vandalism

- Fire, flood, and natural disasters

- Power surge by lightning

What doesn't tablet insurance cover?

Worth Ave. Group insurance plan, like all insurance policies, has exclusions, so it doesn't cover things like:

- Intentional damage

- Cosmetic damage

Why choose Worth Ave. Group tablet insurance?

If you want to protect your tablet with an insurance plan, make sure you choose a trusted, proven, and reliable insurance provider. Worth Ave. Group is a fully licensed insurance agency with high level of customer satisfaction and has over 50 years of experience in providing device insurance for educational institutions, businesses, and individuals. Our insurance plan covers many perils and offers many benefits, such as unlimited claims, low deductibles, and affordable premiums.

How can I get tablet insurance?

If you’re looking for a tablet insurance plan, you can get a free online quote: www.worthavegroup.com/product/tablet-insurance